Homes up to 40% Off

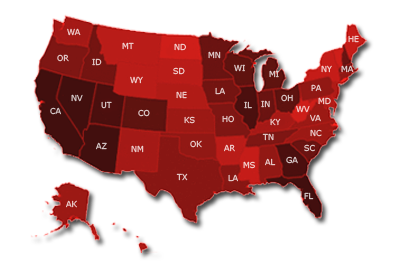

Take a tour of the 82,022 foreclosures!

Fill in the information below to get FREE foreclosure alerts

in your area & receive free foreclosure data!!

Three Ways to Buy

There are three ways you can buy foreclosures and each one has its own distinct discipline.

They are:

Pre-foreclosures, where you buy directly from a homeowner before the bank forecloses;

At auction, where you place a bid, possibly in competition with others;

From a real estate company. This is called an REO.

Pre-foreclosures "Pre-foreclosures are appealing because they require the least amount of capital, and almost all the information you need is available," explains Velvel.

"You can inspect the house and conduct a title search so you won't have any surprises. With a pre-foreclosure, the owner signs a deed and gives you the property.

In return, you acquire the mortgage that comes with it. Plus you have to make the mortgage current by giving the bank any back payments.

The key with pre-foreclosures is to make the sale 'subject to mortgage.' On average you might make ten to 20 percent."

At Auction The exact mechanism varies from one state to another. Auctions can be held on courthouse steps, in the county clerk's office, or in front of the foreclosed house.

"Auctions also carry the most risk," notes Velvel. "At the same time, they can also offer the greatest reward. Sometimes you can make as much as 40% on an auction foreclosure. But you have to know what you're doing."

In an auction, buyers can't inspect the home in advance of the auction, they have to pay in cash, usually with a cashier's check, and sometimes the current homeowner simply refuses to move out. It then becomes the buyer's responsibility to evict the old owner.

Auctions also tend to attract real estate investors seeking a great bargain that they intend to flip (resell) for a quick profit.

If you're looking for a home to live in, an auction is probably not the way to go, in Velvel's view.

REO Real Estate Owned properties or (REOs) represent the third way to buy foreclosures.

"Reo is least risky in terms of what you're buying," says Velvel. "You get to fully inspect the property, demand a clear title, and the sale can be subject to getting a mortgage.

Most banks sell foreclosure properties through a broker. They are considered the safest and also the least financially rewarding of all foreclosure buying options. But properties sold this way also tend to be in better shape.

The downside is that you probably won't get as good a deal as you would with an auction or dealing directly with homeowners who are in a pre-foreclosure category.